are donations to election campaigns tax deductible

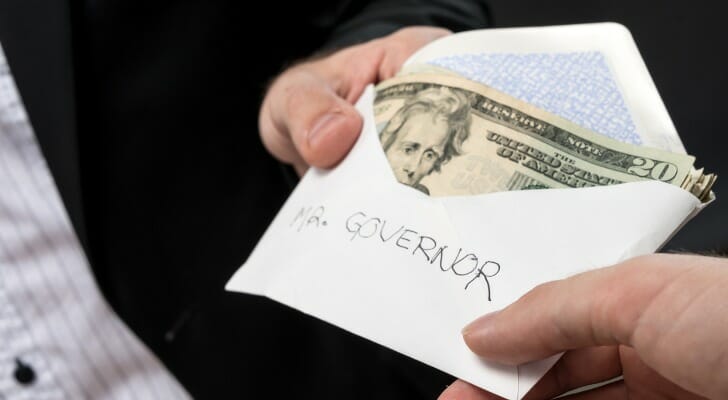

Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible. Are Donations to Political Campaigns Tax Deductible.

Charity Navigator Top 5 Things To Remember When Making Political Donations

Are Political Contributions Tax Deductible Hr Block The answer is no political contributions are not tax deductible.

. Things To Know. Note that donations to campaigns run by individuals are generally not tax deductible. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes.

If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. Though political contributions are not tax-deductible many people still willingly spend their money on the election campaign. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in federal state and local elections and to contribute to the campaign funds of the candidate or party of.

The answer is no donations to political candidates are not tax deductible on your personal or business tax return. If you decided to donate money or time or effort to political campaign you might wonder whether political contributions that you make are tax deductible. This means that when you make a contribution to an organization that has been designated as a 501c3 by the IRS and you have not received anything in return for your gift you are eligible for a.

There are five types of deductions for individuals work. Zee March 2 2022 Uncategorized No Comments. Many charitable contributions are eligible for deduction from your federal and state adjusted gross income.

Donors who are eligible to itemize charitable contributions on income tax returns may include contributions made through the CFC. This change is set to stay in place for tax years 2018-2025. The federal government allows various deductions that can help reduce your taxes but this does not include your political contributions to the campaigns of any organization or individual.

If youre planning to donate money time or effort to a political campaign you might be thinking to yourself Are political contributions tax-deductible No. Wrongfully claiming political contributions can and will attract the attention of the Internal Revenue Service and can lead to an assessment of additional taxes due penalties and interest. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

Even though political contributions are not tax-deductible there are still restrictions on how much individuals can donate to political campaigns. The IRS tells clear that all money or effort time contributions to political campaigns are not tax deductible. While tax deductible CFC deductions are not pre-tax.

You cant deduct contributions to organizations that arent qualified to receive tax-deductible contributions including political organizations and candidates. Are Political Donations Tax Deductible. The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

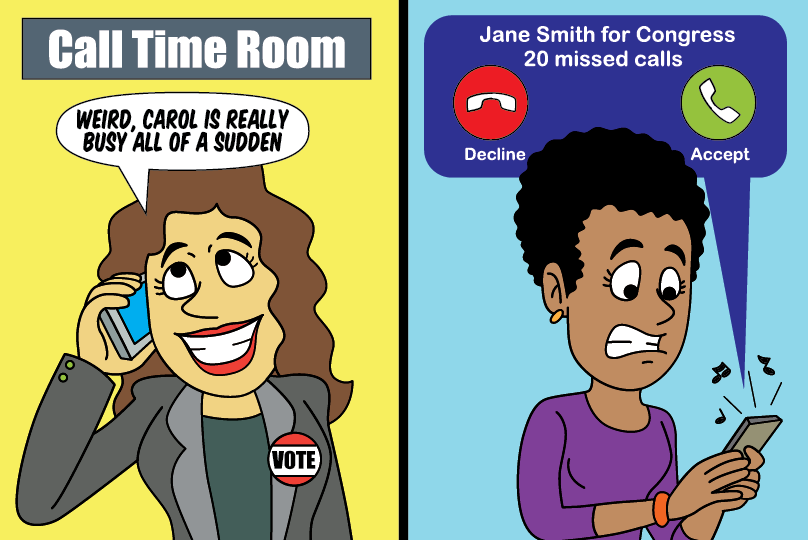

While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns and to support political candidates. Generally donations to these entities are used for advocacy but not direct electoral purposes where youre asking someone to support or oppose an issue. If you are one of those citizens and you were hoping for a tax break unfortunately you wont find one here.

United Kingdom In the UK charitable giving works differently and the charity receives the benefit not the donor. Donations to 501c3 nonprofits are tax-deductible. The 2017 Tax Cuts and Jobs Act changed the rules for claiming the moving expense tax deduction.

A tax deduction allows a person to reduce their income as a result of certain expenses. Campaign contributions and special gifts. Are donations to election.

Donations are tax-deductible if the campaigns beneficiary has 501 c 3 status with the IRS. Are political donations tax deductible 2019. The same goes for campaign contributions.

Political contributions arent tax deductible. Political Contributions Are Tax Deductible Like. Come tax time accountants and tax preparers are often asked Are political contributions tax deductible Unfortunately people are often surprised by the answer which is an emphatic no.

The following materials discuss the federal tax rules that apply to political campaign intervention by tax-exempt organizations. A donation is considered tax-deductible if it was made directly to a charity organization that the IRS deems as a qualifying organization. Below we provide a list that IRS says is not tax deductible.

The simple answer to whether or not political donations are tax deductible is no. The answer is simple No. It doesnt matter if it is an individual business or other organization making the donation the campaign contribution is not deductible.

According to the IRS. Not only does the IRS omit political organizations from its list of qualifying organizations it specifically mentions that they are not eligible for a deduction and they do so. The Federal Election Campaign Act amendments of 1974 set specific limits for campaign contributions.

The irs explicitly says that contributions to political campaigns and candidates are not tax deductible. People love to support their favorite candidate. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible.

Governor lieutenant governor secretary of state auditor of state treasurer of state attorney. Most organizations must complete the IRS process to become qualified so the donation is. Individuals may donate up to 2800 to a candidate committee per election up to 5000 per year to a PAC and up to 10000 per year to a local or district party committee.

Are political contributions subject to gift tax. Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction. Resources for business leagues.

Resources for labor and agricultural organizations. If youre looking to save more on your taxes this year find out if youre eligible for any of these 10 most. For most taxpayers moving expenses are no longer deductible meaning you can no longer claim this deduction on your federal return.

What moving expenses are tax deductible 2017. Resources for charities churches and educational organizations. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax.

They give their time effort and support to the candidates and their parties. Resources for social welfare organizations. This includes political action committees pacs as well.

Are Political Contributions Tax Deductible For Partnerships Ictsd Org

Can You Deduct Political Campaign Contributions From Taxes Money

Why Political Contributions Are Not Tax Deductible

Are Political Contributions Tax Deductible Smart Asset

Federal And California Political Donation Limitations Seiler Llp

Hawaii S Big Donors Pump Millions Into Mainland Political Campaigns Honolulu Civil Beat

Is Your Political Donation Tax Deductible Wsj

Are Your Political Contributions Tax Deductible Taxact Blog

Tax Tip Donations You Can T Deduct Thestreet

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

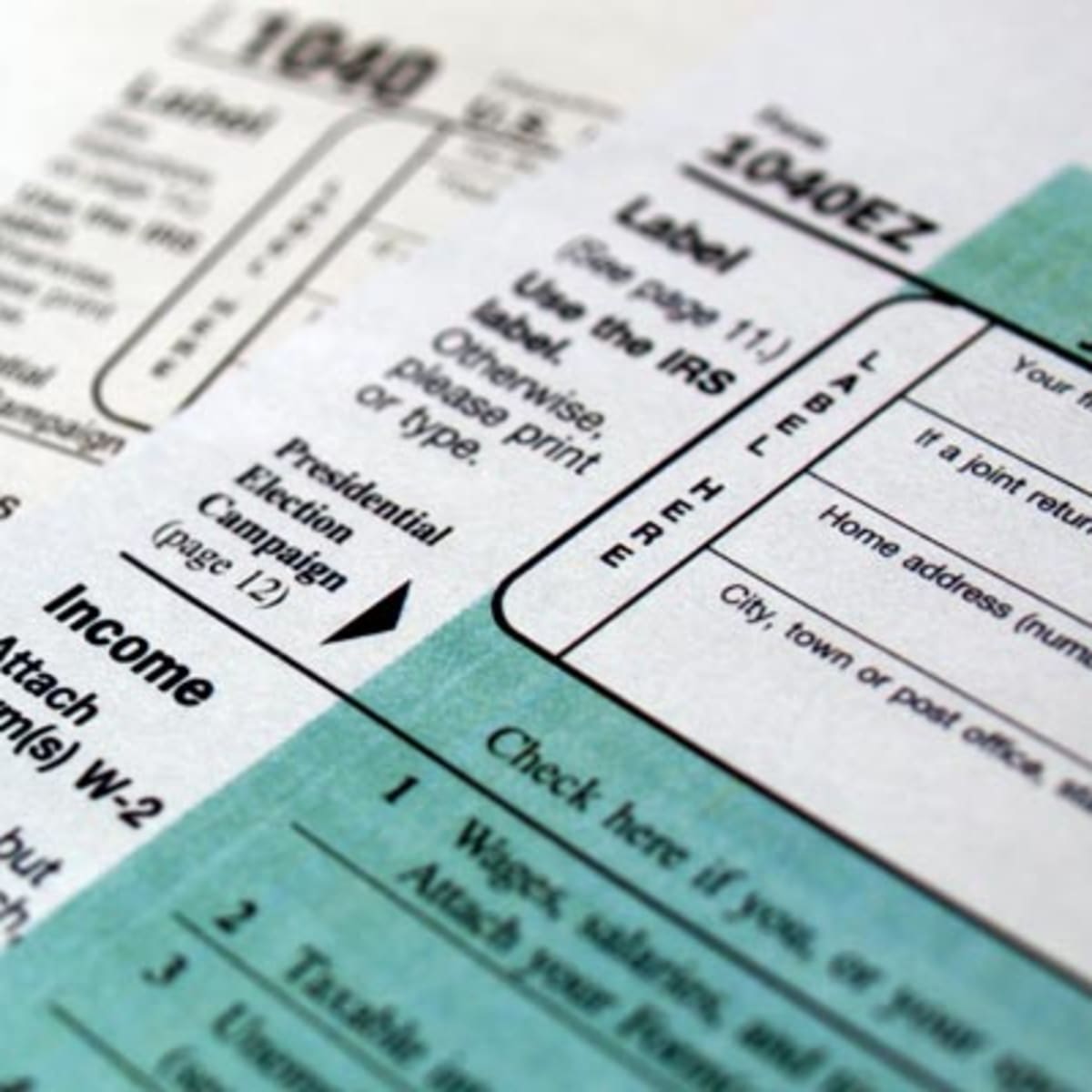

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

Are Political Contributions Tax Deductible Smart Asset

Are Political Donations Tax Deductible Credit Karma Tax

Free Political Campaign Donation Receipt Word Pdf Eforms

Are Political Contributions Tax Deductible Personal Capital

Are Political Contributions Tax Deductible Smart Asset